Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Avoid Future (FUTR) by Steve Moore in ShareProphets

- Avoid Dillistone Group (DSG) by Steve Moore in ShareProphets

- Hold GSK (GSK) by LBBW

- Hold GSK (GSK) by DZ Bank

- Buy Playtech (PTEC) by Deutsche Bank

- Sell AstraZeneca (AZN) by Deutsche Bank

- Buy Anglo American (AAL) by Berenberg

- Buy Shell (SHEL) by Goldman Sachs

- Buy Marks & Spencer Group (MKS) by Goldman Sachs

- Neutral Bunzl (BNZL) by Goldman Sachs

- Buy Linde (0M2B) by UBS

- Buy British Land Company (BLND) by Berenberg

- Buy International Workplace Group (IWG) by Berenberg

- Neutral Glencore (GLEN) by JP Morgan

- Overweight Rio Tinto (RIO) by JP Morgan

- Hold Schroders (SDR) by Jefferies

- Buy Lloyds Banking Group (LLOY) by Ben Martin in The Times - Tempus

- Neutral easyJet (EZJ) by ODDO BHF

- Outperform International Consolidated Airlines Group SA (CDI) (IAG) by ODDO BHF

- Underperform Wizz Air Holdings (WIZZ) by ODDO BHF

Trading Signals - UK 350

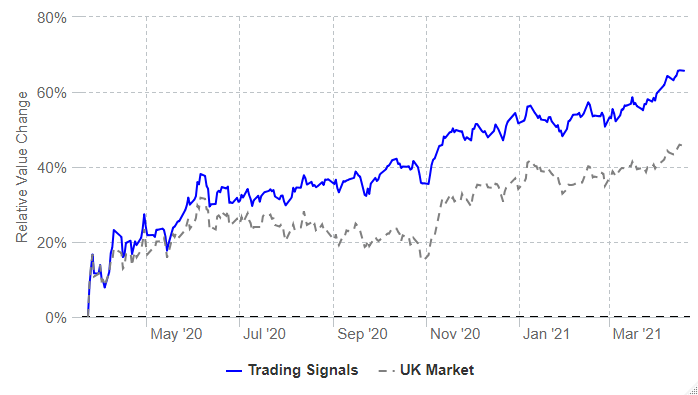

Trading Signals are our pick of the strongest signals and recommendations from the UK’s top ranked market analysts and stock pickers. Our automated algorithm identifies the signals with the greatest chance of positive performance based on the issuer’s persistent skill and past performance against the market and sector in which the stock operates.

UK 350 Trading Signals are selected only from companies in the UK 100 + UK 250 indices, these are comprised of the largest 350 companies in the UK. As they are larger companies, their prices tend to be more stable.

AIM (or Alternative Investment Market) Trading Signals are selected from the companies in the AIM 50 + AIM 100 indices, the largest 150 companies listed on the AIM. These are typically smaller, less developed companies and their prices tend to be more volatile.

UK 350 Trading Signals Summary Since Launching in March 2020

Hit Rate

82%Average Performance

12.2%Number of Trading Signals

218Average Alpha

5.4%Modelled Portfolio

68%Modelled Portfolio

19%above UK Market

Most Recent Closed Trading Signals

| Company | Market | Type | Tipster | StockoScore | Start Date | Date Closed | Performance | Actions |

|---|---|---|---|---|---|---|---|---|

| Wheaton Precious Metals Corp.NPV (CDI) (WPM) | UK 350 | Buy | Berenberg | 17/12/2025 | 26/01/2026 | 30.81% | View | |

| Fresnillo (FRES) | UK 350 | Buy | Berenberg | 17/12/2025 | 30/12/2025 | 13.73% | View | |

| Endeavour Mining (EDV) | UK 350 | Buy | Berenberg | 17/12/2025 | 29/01/2026 | 25.86% | View | |

| Antofagasta (ANTO) | UK 350 | Buy | Berenberg | 17/12/2025 | 30/12/2025 | 7.10% | View | |

| Anglo American (AAL) | UK 350 | Buy | Berenberg | 17/12/2025 | 21/01/2026 | 18.12% | View | |

| SSE (SSE) | UK 350 | Buy | Goldman Sachs | 26/11/2025 | 04/02/2026 | 17.92% | View | |

| Airtel Africa (AAF) | UK 350 | Overweight | Barclays | 21/11/2025 | 22/12/2025 | 9.37% | View | |

| Beazley (BEZ) | UK 350 | Overweight | Barclays | 18/11/2025 | 19/01/2026 | 28.95% | View | |

| National Grid (NG.) | UK 350 | Buy | Goldman Sachs | 07/11/2025 | 02/02/2026 | 7.77% | View | |

| Anglo American (AAL) | UK 350 | Buy | Berenberg | 30/10/2025 | 02/01/2026 | 7.34% | View |