Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Market Perform BAE Systems (BA.) by Bernstein

- Hold InterContinental Hotels Group (IHG) by Deutsche Bank

- Neutral Glencore (GLEN) by Goldman Sachs

- Outperform Weir Group (WEIR) by RBC Capital

- Buy Haleon (HLN) by Berenberg

- Neutral Schroders (SDR) by UBS

- Sector Perform Conduit Holdings Limited Com Shs (DI) (CRE) by RBC Capital

- Buy Kier Group (KIE) by John Ficenec in The Times - Tempus

- Avoid Microsaic Systems (MSYS) by Steve Moore in ShareProphets

- Avoid Aptamer Group (APTA) by Steve Moore in ShareProphets

- Avoid Transense Technologies (TRT) by Steve Moore in ShareProphets

- Outperform Linde (0M2B) by Bernstein

- Avoid Boohoo Group (BOO) by Steve Moore in ShareProphets

- Watch Raspberry PI Holdings (RPI) by Edward Sheldon in The Motley Fool

- Buy Antofagasta (ANTO) by Bank of America

- Outperform Relx plc (REL) by ODDO BHF

- Outperform Chesnara (CSN) by RBC Capital

- Buy Yellow Cake (YCA) by Berenberg

- Outperform NextEnergy Solar Fund Limited Red (NESF) by RBC Capital

- Buy Applied Nutrition (APN) by Deutsche Bank

UK Trade Deal

Headlines say Trump to announce trade deal with UK and all stock picks are a mix of 78% BUY, 15% HOLD and 7% SELL

1. STRONG BUY KEFI Gold and Copper

Top performing stock pick this week is STRONG BUY KEFI Gold and Copper by Hot Stock Rockets with a tip performance of 11%.

KEFI Gold and Copper is a gold exploration and development company focused on gold and copper deposits, primarily in the Arabian-Nubian Shield. They operate in Ethiopia and Saudi Arabia.

KEFI Gold and Copper share price launched at 66p in 2008, rose to an all-time high of 157p in 201 and is today at 0.54p.

On 6th May Kefi announced in this RNS the approval of Ethiopian Country Membership for AFC (Africa Finance Corporation)by Ethiopian Council of Ministers. AFC is one of KEFI's co-lenders for the Tulu Kapi Gold Project. Country Membership is a critical condition precedent for AFC's participation in the Project financing alongside Eastern and Southern African Trade and Development Bank which already has Ethiopian Country Membership. Membership is now with the Ethiopian Parliament for proclamation in legislation. Shares increased 6% that day as a result and up 11% during the week.

In Stockomendation one analyst which is Hot Stock Rockets with STRONG BUY. There are no active short positions open.

2. OVERWEIGHT Aston Martin Lagonda

Second top performing stock pick this week is OVERWEIGHT Aston Martin Lagonda Global Holdings by Barclays with a tip performance of 9%.

Aston Martin Lagonda Global Holdings is a British manufacturer of luxury sports cars and grand tourers. Aston Martin has held a royal warrant as purveyor of motorcars to Charles III (as Prince of Wales and later as King) since 1982, and has over 160 car dealerships in 53 countries. The company is traded on the London Stock Exchange and is a constituent of the FTSE 250 Index.

Aston Martin share price launched at 4,046p in 2018, its all-time high, and is now at 79p.

On 30th April the company issued first quarter results in this RNS. Shares rose 2% to 72p on the announcement that it is limiting the number of cars exported to the US due to the impact of automotive tariffs, but said it still expects to hit its full-year targets for 2025.

The US was the sports car company's third biggest market last year.

In Stockomendation five analysts: Bernstein with OUTPERFORM, Barclays with OVERWEIGHT, JP Morgan is NEUTRAL and Deutsche Bank and HSBC have HOLD. Seven UK fund manager short positions open, view those here.

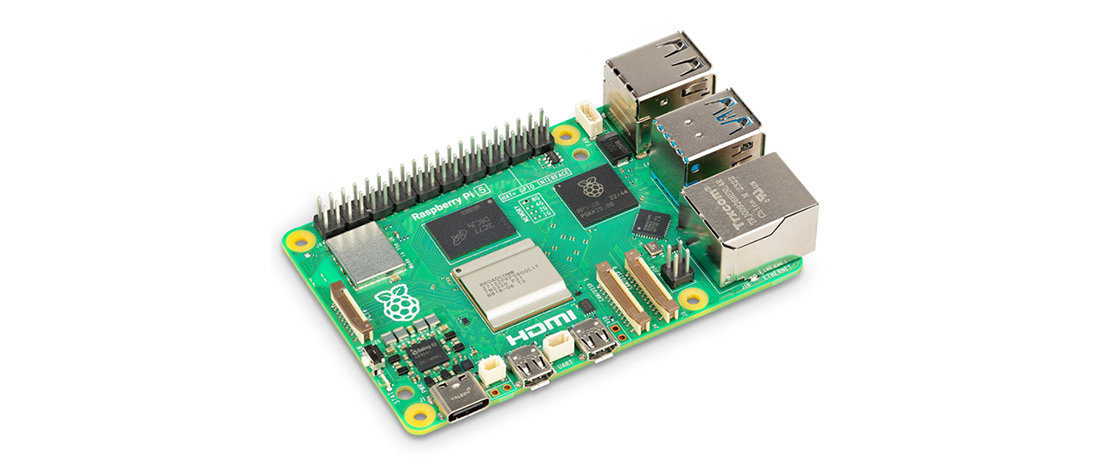

3. BUY Raspberry PI Holdings

Third top performing stock pick this week is BUY Raspberry PI Holdings by Tom Saunders in The Times - Tempus with a tip performance of 6%.

Raspberry Pi Holdings is a technology company based in the United Kingdom, focused on designing and manufacturing single-board computers and related products. The company is listed on the London Stock Exchange and is part of the FTSE 250 Index. Raspberry Pi's products cater to a wide range of users, including enthusiasts, educators, and businesses, with applications in various areas like the Internet of Things and embedded systems.

Raspberry Pi share price launched at 420p in 2024, rose to an all-time high of 766p in 2025 and is today at 464p.

In his article Saunders highlights the benefits of buying this stock amidst Trump tariff uncertainty as the company has relocated its operations from China to Wales and sources a key component of its single board computers from the USA, in comparison to competitors which mostly source from China. It is trading at 42 times its expected earnings compared to Apple at 28 times and Nvidia at 23.

Saunders is bullish about Raspberry Pi’s products and company strategy and concludes with ‘attractive business and possible tariff protection.”

In Stockomendation four analysts – Tom Saunders and Jefferies with BUY; Deutsche Bank and Alan Oscroft with HOLD. Four UK fund manager short positions open, view those here.

Join Now

Think you can pick stocks? Play the May league UK Share Picking game FREE : uksharepickinggame.co.uk

Disclaimer: The contents of this article should not be considered financial advice. Pricing data correct as at 8th May 2025.