The Banco Santander (LSE:BNC) share price remains higher than it was at the start of the year. But fears over the global banking sector and a cooling world economy have prompted a sharp decline more recently.

Santander shares are now trading 18% more cheaply than they were two months ago. This means that (on paper at least) they offer brilliant all-round value.

Should you invest £1,000 in Banco Santander right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Banco Santander made the list?

The bank currently trades on a forward price-to-earnings (P/E) ratio of 5.2 times. It’s a reading that’s lower than those of FTSE 100 retail banks Lloyds and NatWest.

Investors can also enjoy a market-beating 5.1% dividend yield for 2023. So is now the time to buy Santander shares?

Banking worries

Mounting stress in the US banking system remains a big problem for banks around the globe. First Republic is the latest in a string of failures and this week had to be rescued by JP Morgan.

There’s still no sign of a worldwide banking sector meltdown. With the very obvious exception of Credit Suisse, the problems appear to be confined to small-to-mid-sized US banks.

But the problem for bigger global operators like Santander is that depositors in some regions are pulling their cash out en masse. And as more banks in the States come under pressure, the greater the chance of a full-blown run on other banks.

Brits withdrew a record £4.8bn worth of cash from banks in March, according to the latest Bank of England data. A hastening of outflows across the globe wouldn’t likely be fatal to bigger retail banks. But it could put firms’ balance sheets under severe pressure and disrupt their everyday operations.

Revenues soar

Mass withdrawals of course aren’t the only problem for Santander. Weakening economic conditions in its European and Latin American marketplaces could hit revenues and push credit impairments steadily higher. Bad loans here soared 56% in the first three months of 2023, to €3.3bn.

Yet the prospect of more interest rate rises helps to lift the gloom around the bank. Higher rates increase the margin between the interest retail banks charge borrowers and give to savers (known as the net interest margin, or NIM).

Total income at Santander rose 13% during quarter one to €13.9bn. This was driven by a 17% improvement in NIM. Consequently, group attributable income rose 1% year on year, to €2.6bn.

Why I’d buy Santander shares

But I wouldn’t buy Santander shares based on its near-term outlook. Instead, I’d buy this banking share because of its strong position in fast-growing Latin America and Eastern Europe.

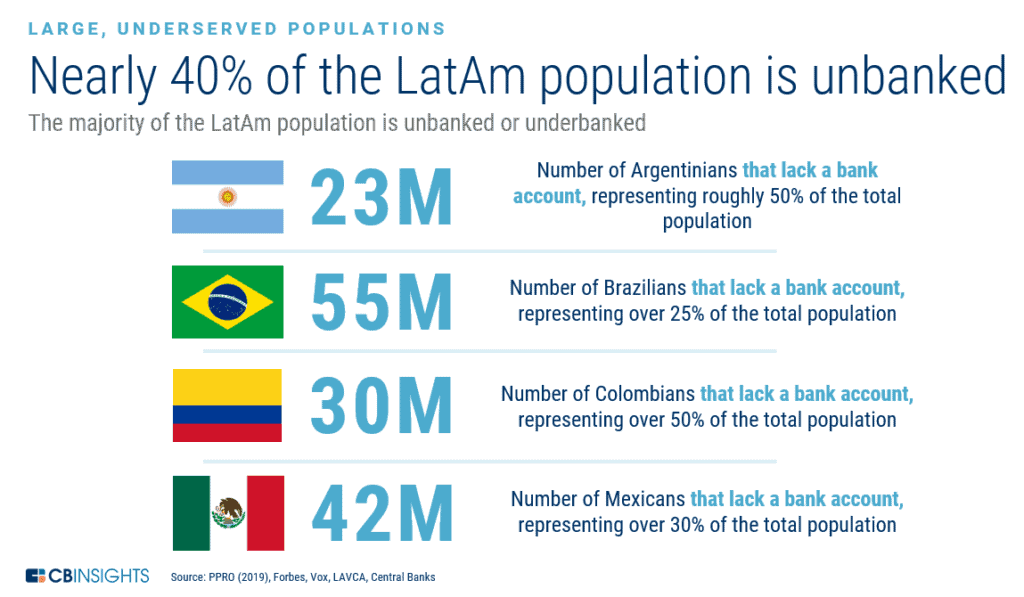

Financial product demand in these emerging regions is booming as disposable income levels increase and populations rapidly rise. Market penetration is incredibly low — as the graphic above shows — and this provides huge scope for banks to grow profits.

Santander has invested more than €35bn in Latin America since the mid-90s to exploit this opportunity. And it has exciting plans to continue growing profits here. Felipe Garcia, head of the firm’s Mexico operations, told Reuters it plans to launch digital lender Openbank there by March 2024.

I’ll be looking to add the Spanish bank to my portfolio when I have spare cash to invest.