Search for Companies, Tipsters or Sources…

Companies

Tipsters

Brokers

Sources

Or view the latest share tips

Company Results

Tipster results

Broker results

Sources results

Fund Manager results

Tips from these results

- Buy Henderson Far East Income Ltd. (HFEL) by Christopher Ruane in The Motley Fool

- Buy Big Yellow Group (BYG) by Oliver Rodzianko in The Motley Fool

- Avoid Vianet Group (VNET) by Steve Moore in ShareProphets

- Avoid Kromek Group (KMK) by Steve Moore in ShareProphets

- Buy NATWEST GROUP (NWG) by Bank of America

- Buy London Stock Exchange Group (LSEG) by Bank of America

- Hold AstraZeneca (AZN) by DZ Bank

- Avoid Trifast (TRI) by Steve Moore in ShareProphets

- Buy NATWEST GROUP (NWG) by Shore Capital

- Hold Central Asia Metals (CAML) by Canaccord Genuity

- Buy Oxford Metrics (OMG) by Canaccord Genuity

- Buy Atalaya Mining (ATYM) by Canaccord Genuity

- Hold BHP Group Limited NPV (DI) (BHP) by Berenberg

- Buy Taseko Mines Limited NPV (DI) (TKO) by Canaccord Genuity

- Underperform AB Dynamics (ABDP) by Jefferies

- Buy AstraZeneca (AZN) by Stifel

- Buy QinetiQ Group (QQ.) by John Fieldsend in The Motley Fool

- Hold Antofagasta (ANTO) by Canaccord Genuity

- Hold Reckitt Benckiser Group (RKT) by Deutsche Bank

- Hold London Stock Exchange Group (LSEG) by Deutsche Bank

Budget Cuts Tax

New budget cuts tax & all stock picks are a mix of 79% BUY, 11% SELL and 10% HOLD.

1. SELL Dukemount Capital

Top stock pick this week is SELL Dukemount Capital by Tom Winnifrith in ShareProphets with a tip performance of 57%.

Dukemount capital is a real estate investment firm that was founded as Black Eagle Capital, a VC firm in 2011.

Dukemount Capital share price launched at 4.5p in 2017, rose to an all-time high of 11.25p in 2020 and is today at 0.044p.

In his article Winnifrith comments on the dilution and sale of shares at 60% discount.

In Stockomendation two out of three analysts say BUY they are Shore Capital and Peter Brailey with Tom Winnifrith saying SELL. There are no active short positions open.

2. OUTPERFORM Oxford Biomedica

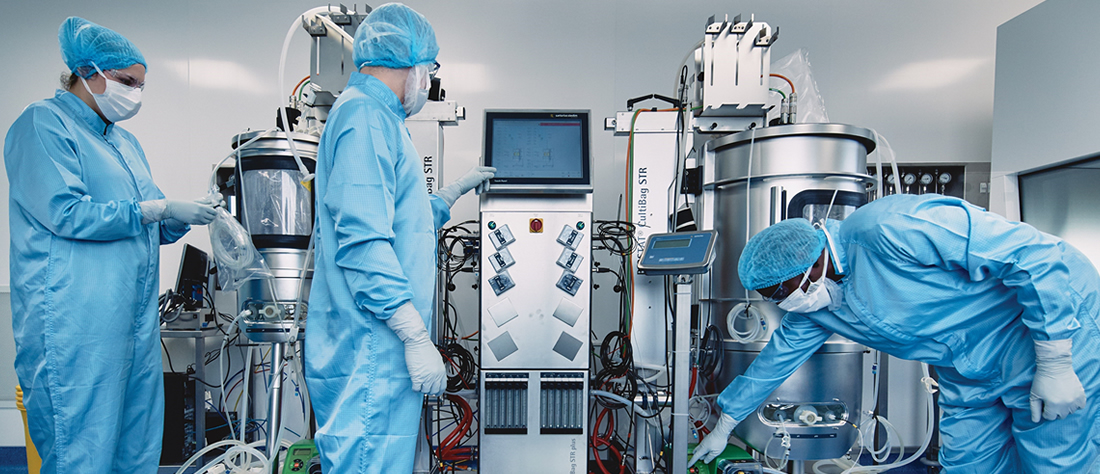

Second top performing stock pick this week is OUTPERFORM Oxford Biomedica by RBC Capital with tip performance of 15%.

Oxford Biomedica is a cell and gene therapy company based in Oxford.

Oxford Biomedica share price launched at 2,374 in 1996, rose to an all-time high of 4,625p in 2000 and is today at 194p.

In the news this week due to £68m of investment from Serum Institute of India in return for 3.9%, shares jumped 13% in the week. Interim results in line with expectations were released in this RNS on Tuesday.

In Stockomendation RBC Capital says OUTPERFORM, JP Morgan is NEUTRAL and Liberum Capital says HOLD. There is one active short position open, view that here.

3. OVERWEIGHT Trustpilot

Third top performing stock pick this week is OVERWEIGHT Trustpilot Group by JP Morgan with a tip performance of 8%.

Trustpilot is a Danish online review site, founded in Denmark in 2007 by its former CEO, Peter Holten Mühlmann. The company started when Mühlmann’s parents began shopping online, and he decided to create a platform for consumer reviews. Trustpilot has grown significantly since then, hosting nearly 1 million new reviews each month from users around the world. In 2013, it expanded by opening offices in New York and London.

Trustpilot share price launched at 265p in 2021and is today at 199p.

In the news this week when JP Morgan raised the target price to 250p from 190p after upgrading the rating to OVERWEIGHT from NEUTRAL in February 2023.

In Stockomendation JP Morgan has OVERWEIGHT and Berenberg says BUY. There are no active short positions open.

UK Fund Manager Short Positions

See which UK Fund Managers are betting against your investments by accessing current & historical short positions on UK companies showing you which fund manager has shorted which company and by how much.

Think you can pick stocks? Play the March league UK Share Picking game FREE : uksharepickinggame.co.uk

Disclaimer: The contents of this article should not be considered financial advice. Pricing data correct as at 7th March 2024.